Inspired from a conversation with a friend, this post discusses a potential duo for starting a business (not a startup) with a high reward to risk ratio. We will talk about what the duo for this situation, the market imbalance that creates value for this duo and investigate key requirements needed for the duo to work. Obviously I haven’t been a part of the duo, but this is my speculation on what a partnership like this will potentially look like.

What?

In a one sentence, the duo is a builder-type software engineer + a capable individual that works at a non-tech industry like finance or real estate. The goal of this duo is to minimize the risks and maximize the gains for building a business.

First of all, why build a software product? According to Naval:

Code and media are permissionless leverage. They’re the leverage behind the newly rich. You can create software and media that works for you while you sleep.

Nothing that has more leverage than software. One can build a great piece of software in a weekend that reaches hundreds of thousands of people. Building a software product is a way to minimize the cost put into the business, with the only cost being the opportunity cost of the engineer.

Secondly, why build software for a non-tech / traditional industry? This is because this person is able to have a deep understanding of the industry and have the necessary soft skills to understand and sell to customers.

How

Why is there such an imbalance in the market that there’s still room for the duo? I speculate that there’s a few reasons.

In society, relationships, talent and expertise are clustered. It’s not surprising that software engineers mingle other software engineers, founders hang out with other founders etc. This is intuitive and simply a result of shared interest and common language, networking opportunities and professional development.

This explains why there’s a different level of competition for saas companies in different fields, with tech being the most competitive. You see a high levels of competition in spaces like project management tools, database providers, etc. but you don’t see high levels of competition in spaces like finance automation or real estate databases. Engineers understand themselves the most, so they build product based on their expertise and past experience.

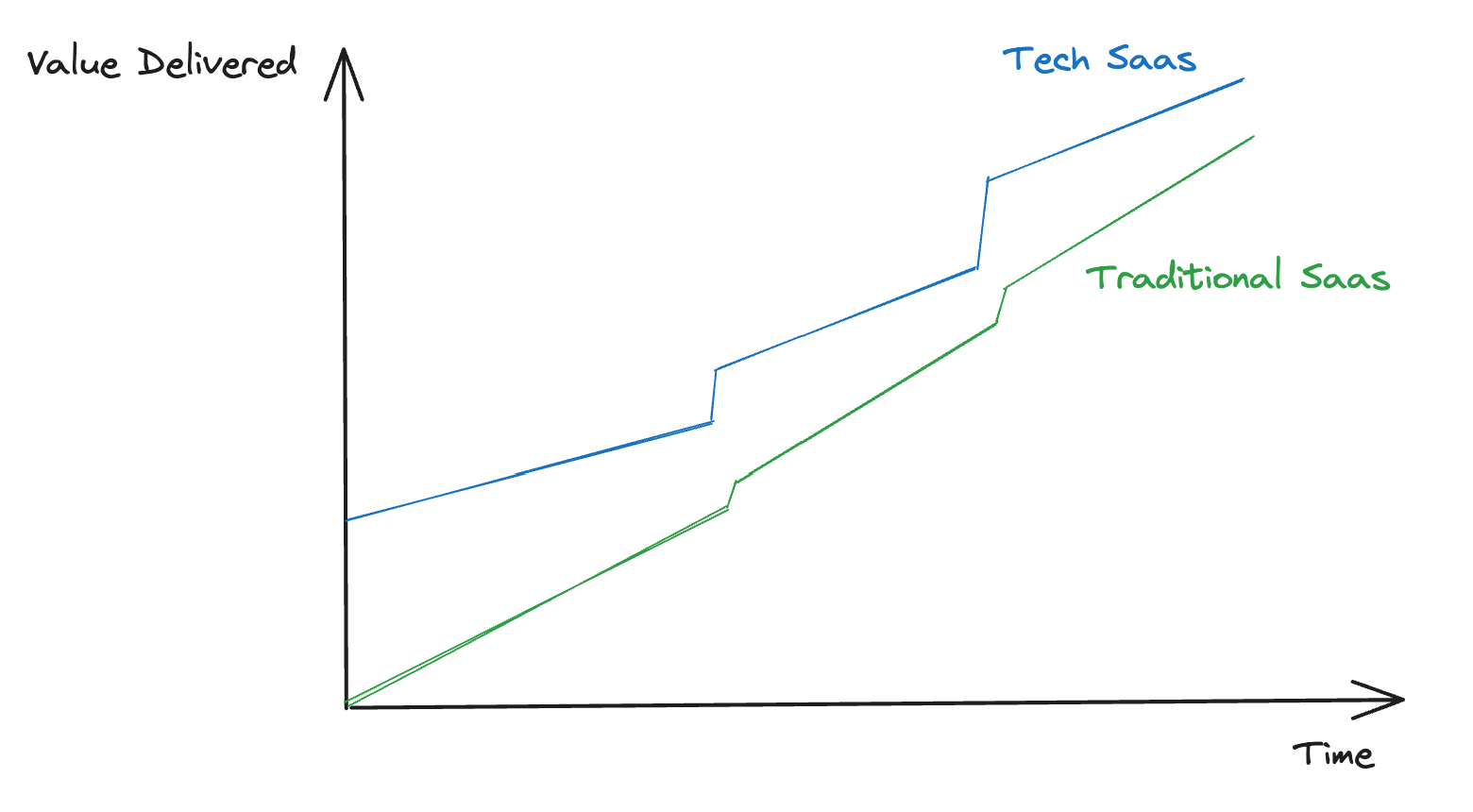

New technology will always trickle down from tech to non-tech. This inherent between the most cutting edge technology and non-technical industries will never close. Sometimes the gap will be large when when there are new innovations like breakthroughs in AI, and over time, the gap will decrease as the market catches up. With this being said, the boom of AI has increased the gap significantly and it’s created a huge opportunity to capture the value created by this imbalance.

This is why the non-technical member of the duo is so important. They work in a field that is distant from tech, that has its own set of expertise, problems, and way of doing things that 99%+ of engineers cannot understand well. The engineer can’t sell a product in a space that they don’t understand. The farther from tech, the lower the competition. The technical member can bring the cutting edge ideas to help solve problems in this space.

TODO: graph on gap

Secondly, why isn’t a duo like this more prevalent?

Requirements

Realistically, you can’t just pair up any engineer and anybody in a non-tech industry to build a successful product. The thesis of the duo may seem obvious, but there are some strict requirements for the duo that go beyond their professions. In my opinion, the success criteria are follows:

- TODO:

Other Thoughts

You also see lots of indie hackers on twitter who can leverage software and make big money building “general” software by themselves (survivorship bias), how does this model compare to the duo and what takeaways can we learn from these twitter indie hackers?

Potential Concerns

Is there anything else that I’m missing when analyzing the reason for the imbalance? Probably.

There may be reasons like regulations / compliance issues that make it inherently hard to sell to these companies. According to Paul Graham’s Superlinear returns:

A principle for taking advantage of thresholds has to include a test to ensure the game is worth playing. Here’s one that does: if you come across something that’s mediocre yet still popular, it could be a good idea to replace it. For example, if a company makes a product that people dislike yet still buy, then presumably they’d buy a better alternative if you made one. [5]

[5] Not always, though. You have to be careful with this rule. When something is popular despite being mediocre, there’s often a hidden reason why. Perhaps monopoly or regulation make it hard to compete. Perhaps customers have bad taste or have broken procedures for deciding what to buy. There are huge swathes of mediocre things that exist for such reasons.

One can also argue that the market cap is lower and that there’s a lower ceiling in the companies that you can sell to and the values you can create.

Closing

All that being said, with a unique angle and creative problem solving, I believe that there’s lots of room to create value, or in other words, make free money.

References

Lecture 13 - How to be a Great Founder (Reid Hoffman) https://www.youtube.com/watch?v=dQ7ZvO5DpIw 11:38

What do I know that other people don’t know?

Big TAM Founders, Small TAM Startups https://anu.substack.com/p/small-tam-startups

To drill down more, they see less market risk. And even the execution risk seems manageable. Execution is largely a matter of operational consistency (e.g. sticking to a newsletter format and schedule) rather than niche expertise (e.g. retail supply chain management). As a result, a smart generalist can run the business, and it can just hire more smart generalists to help.